Globalization, Global Supply Chain Disruptions, and COVID-19

Introduction

The COVID-19 pandemic has brought unprecedented disruption to the global economy and world trade. Retail sales in the U.S. plummeted 8.4% in March and another 16.4% in April. The German economy contracted by 2.2% in the first quarter of the year—the largest economic contraction in the country since 2009. The economic slump is even more severe in France, Spain, and Italy, where first-quarter output fell by 4.7%, 5.2%, and 5.8%, respectively. In China, gross domestic product shrank by 6.8% in the first three months of the year, bringing its long-run economic growth that began with trade and economic reform in 1979 to a halt.

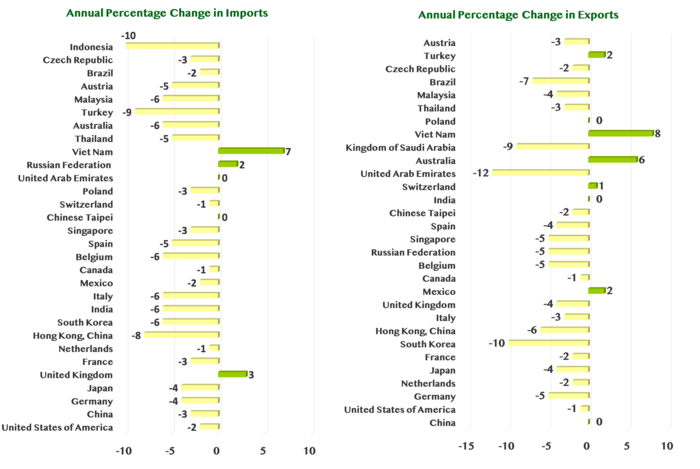

With all major economies in fall out, world trade is slowing down as expected. Moreover, the pandemic hit as the world trade system was already being affected by trade tensions between the U.S. and China (see Figure 1). The World Trade Organization (WTO) has predicted that world merchandise trade will decline between 13% and 30% in 2020 (see Figure 2). The predicted fall is severe across all regions, with the sharpest decline in exports from North America and Asia.

There is also a growing concern that nations may "turn inward" and follow protectionism, neutralizing gains made since the establishment of the WTO and its predecessor the General Agreement on Tariffs and Trade. The open trading system of the world has allowed countries to integrate production processes across borders, offshore production stages, purchase input materials, and specialize in the production stage commensurate with their skill, technology, and resources. Many of these provisions in international trade are age-old practices, but the use of imported goods and services as components of products countries export and consume domestically have featured prominently in international trade since the 1980s.

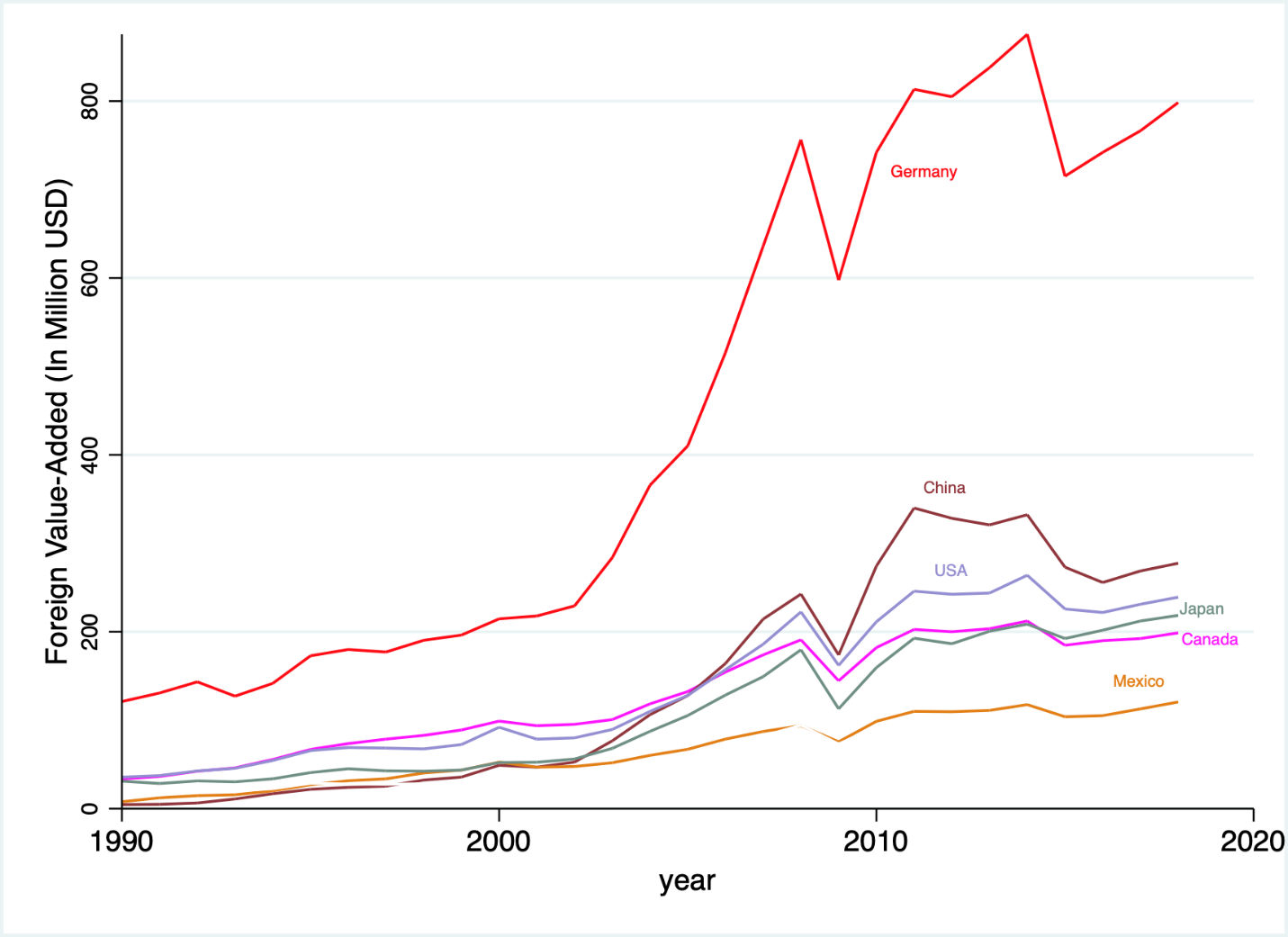

Figure 3 uses the Eora input-output database from 1990 to 2018 to show the trend in foreign inputs embedded in exports from the U.S. and its five major trade partners. As shown in the figure, the external inputs in U.S. exports increased from $35.7 million to $239 million during this time frame – an increase of nearly 3.5 times after adjusting for inflation. Germany, Japan, Mexico, and Canada's use of foreign materials in final exports grew 2.6 times or more during the same time period. For China, the increase is even more dramatic, with the foreign value-added in Chinese exports being four times higher than in 2001 when China joined the WTO. These trends in the external value-added side of trade highlight the increasing mutual dependency among countries in production processes. As a result, economic bliss and woes in one nation propagate across countries through the deeply integrated supply chains and sectoral linkages.

Figure 1: Change in Merchandise Trade from 2018 to 2019

Countries are reverse ordered by their market share ranking from top to bottom in each panels. Source: Based on WTO secretariat estimates.

Global Supply Chain Disruptions

When the coronavirus outbreak caused China to shut down its factories and production centers in late January 2020, Japan's Nissan and South Korea's Hyundai Motors suspended vehicle assembly in their home-based plants in early February due to a shortage of electrical components and auto-parts supply. Now, as China re-emerges from the lockdown, its supply and demand-sides have reportedly rebounded.

China’s value-added in high-tech manufacturing and equipment manufacturing grew by 10.5% and 9.3%, respectively, from March to April. Although the increase in demand falls short of supply, the rebound in economic activity comes at a much needed time for the rest of the world as many other countries are starting to reopen their economies.

In particular, China’s experience may be predictive for other countries who shut down and opened up long after China. Additionally, when manufacturing activities in China increase, industries downstream (sectors using these manufacturing products as intermediate inputs) in other countries benefit through global supply chain linkages.

In a production system with global supply chain linkages, factor endowments (the availability of different resources) affect the positioning of countries along the chain. For example, less developed countries with abundant supply of agricultural land tend to have an outsized role in agricultural supply chains, while others have extensive participation in manufacturing supply chains. Economies abundant in skilled-labor have a comparative advantage in producing skill-intensive goods. They benefit from importing less-skill intensive goods from low-skilled labor abundant countries. Therefore, within the manufacturing sector, relatively less developed economies specialize in low-tech manufacturing.

Figure 2: Future Trade Performance

Click here to see all charts for Figure 2.

Figure 3: Use of Foreign Inputs in Exports

Values are in the current year USD. Source: Estimates based on Eora Database.

More advanced economies, such as China, are involved in both high-tech and low-tech manufacturing. A few advanced economies, such as the U.S., Germany, and Japan, are engaged in the production of innovative goods and services. Therefore, it is hard to generalize supply chains across industries. Further, depending upon the length of the supply chain, the level of integration across production segments, and the amount of value addition at each stage, disruption in some value chains may have more far-reaching consequences for the global economy than others.

The current pandemic has affected all the major global economies whose manufacturing sectors form the center of global supply chains. China, Korea, Italy, Japan, the U.S., and Germany together account for about 60% of the world’s manufacturing production. These economies not only depend on each other for material inputs and offshore production stages to each other, but they also act as primary (and potentially low-cost) suppliers of industrial inputs to other nations.

Figure 4 illustrates the dependence on foreign inputs in automobile manufacturing for the U.S. and its top five trade partners: Canada, China, Japan, Mexico, and Germany. For each, China's value-added accounts for at least 3% of final exports. Together, China, Canada, Mexico, Japan, and Germany account for over 15% of the value of U.S. automobile exports, while the U.S., Mexico, Germany, Japan, and China account for 36% of the value of Canadian exports of vehicles, trailer and semi-trailers manufacturing.

While the five global giants are prevalent in automobile supply chains, regional dominance is also apparent in automobile manufacturing. For example, France, Italy, U.K., and Spain (European Union member countries) and Switzerland (European Union Free Trade Association member) together account for 12% of the value added in Germany's passenger cars and parts and other vehicle manufacturing. The U.S. dominates the supply chain in North America, while China and Japan dominate in East Asia.

Further nuance in regionality is also visible. South Korea contributes at least 2% of the value added for China's transport equipment and vehicle fittings production manufacturing. Although not shown in the chart, many smaller economies such as Taiwan, Philippines, Malaysia, and Vietnam are co-suppliers to their regional hubs of Japan and South Korea. The tight interconnectedness in the supply chain implies that the demand or supply shock in one part will affect production and consumption activities in another part of the world. In the current pandemic, this means that the countries that do not experience large direct effects from the coronavirus still experience a disruption in their economy.

Figure 4: Use of Foreign Inputs in Automobile Manufacturing in 2016

Click here to see all charts for Figure 4.

Trade Barriers, Tariffs and Protectionism

Supply chain disruptions may be severe when trade barriers are high. In principle, firms have options for offshoring products from around the world. In addition to considering the quality and cost of products, selecting which products to offshore and which countries to purchase from will mostly depend on the initial setup and search costs. Additionally, deciding whether to continue offshoring from a particular country will depend on the marginal cost (trade cost for an additional unit). These costs are affected by regulatory barriers such as tariffs and non-tariff barriers, inefficient infrastructure, and delays in customs clearance. Tariff costs tend to be even more significant because global value chains are capable of magnifying their impacts.

One reason that the impacts of tariffs are magnified by global value chains is that these duties are based on the gross import value of a product rather than on the value added at its most recent production stage. Consequently, the effective tariffs are higher when the value-addition at the point of exports is smaller. For example, if a 25% tariff is applied to a “Chinese” product that sells for $100 at the U.S. border, where final assembly occurs in China using $90 worth of parts from the U.S., Germany, and South Korea, a $25 tariff will apply. This amounts to a 250% tariff applying to Chinese value-added of $10.

Tariffs also increase the cost of imported intermediate products as they are passed down along the value chain. For example, as illustrated in Figure 4, a duty imposed by the U.S. on Chinese automobile products may hurt Mexican firms downstream as they use U.S. inputs with Chinese content in transport equipment manufacturing.

Moreover, as goods cross borders back and forth in the supply chain, tariffs intended to protect one domestic industry may mean tariffs applied to other domestic industries. This is apparent in the example above (with a “Chinese” product sold for $100 at the U.S. border), where a portion of the $25 U.S. import tariff is based on the value of inputs produced in the U.S.

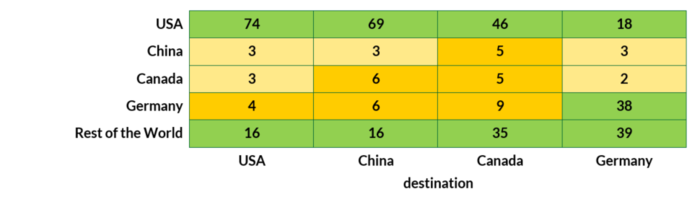

In the case of the automobile industry, the U.S. input share that returns home via foreign exports is particularly high (see Figure 5). As shown in the figure, 74% of the inputs in Mexico's motor vehicle exports to the U.S. come from the United States. The indirect value-added (the input contribution via the third country) of the U.S. in Mexico's exports to China (69%), Canada (46%) and Germany (18%) are also high.

Trade costs, including tariffs and transportation costs, compound along the value chain in a multi-stage sequential production process. Thus, downstream stages tend to have a higher incidence of trade costs than upstream stages, which are further from final consumption. Therefore, less developed countries and/or countries located peripheral to the production centers often specialize in upstream stages to avoid large transportation costs and tariff escalation. This means trade costs may affect not only participation but also the positioning of a country in the supply chain, especially when trade cost is proportional to the gross value of the good being shipped.

Figure 5: Foreign Input in Mexican Motor Vehicle Exports

Foreign input use in Mexico’s motor vehicles exports for 2014. Cells along the column represent the material sourced from Mexico’s four main trade partners and rest of the world aggregate in its exports to each of the four destination shown in the horizontal axis. Source: De Gortari (2019).

Tariffs and trade costs may not be the only factors affecting a firm's choice of input mix, but there is clear evidence that similar goods sold in different countries and industries use different input mixes. Consider the case of motor vehicle manufacturing; even in this relatively narrowly defined sector, Mexico uses entirely different input mixes in its exports to each of its top partners (see Figure 5). As shown in the chart, Mexico uses more material imported from Germany in its exports to Germany than in its exports to China.

However, what is true for the automobile sector may not be so for other industries. For example, in the agricultural sector, where most products are time-sensitive and services cannot be postponed, supply chains tend to be more regional. Further, in this sector, non-tariff barriers (such as Sanitary and Phyto-Sanitary measures) tend to be high. As a result, the effect of tariff barriers is likely to be amplified, especially now that the cargo freight rates have increased dramatically in the current pandemic.

While there are differences in value chains formed across sectors, a commonality among value-chains in different sectors is that they are made up of a network of firms spread across borders, often with synchronized goals and activities for co-existence. Importantly, productivity gained at any stage of the process is passed upstream and downstream along the chain, reinforcing its survival. Therefore, protectionist trade measures such as tariffs aimed at curbing imports and taming competition between domestic and foreign firms may be misplaced and potentially disruptive to the whole value chain.

When the U.S. increased tariffs from 2.6% to 16% covering 12,043 products in 2018, the U.S. imports of targeted products fell by 2.5%. The estimated impact on the export side shows that the retaliatory tariffs led to a 9.9% reduction in U.S. exports of the targeted products. Furthermore, these estimates likely understate the impacts of the tariffs since they do not consider the full linkages across products and sectors formed by global value chains.

Conclusion

Tariffs are just one form of protectionism. A country’s policies on foreign investment, ownership of intellectual property rights, immigration, digital technology adoption, compliance with health and safety regulation standards, and more are also important determinants affecting the open trading system of the world. Additionally, other factors where policymakers have little say, such as distance, contiguity of borders, language, and religion, also affect bilateral trade. Where value chains have formed, thrived and flourished, it is hard to imagine these factors haven't shaped them. Viewed this way, the open trading system of the world looks almost like a dynamic ecosystem, where geopolitical influences, cross-cultural linkages, and language influences are balanced for mutual growth and prosperity.

The mutual dependencies and interconnectedness of supply chains highlight the critical role the open trading system will play in a global economic recovery. Given the economic damage created by the pandemic and the accompanying shutdowns, factories and production centers across the world need the open trading system in order to re-emerge at full efficiency and bring employment back to pre-pandemic levels. As the world is preparing to re-emerge from this global economic shock, pursuing protectionist policies would immensely delay the economic recovery and add to the economic harm already caused by the pandemic.

About the Author

Anupa Sharma

Assistant Professor of Agribusiness and Applied Economics and Fellow of the Sheila and Robert Challey Institute for Global Innovation and Growth at North Dakota State University

Author Bio anupa.sharma@ndsu.edu

Released June 2020

The Sheila and Robert Challey Institute for Global Innovation and Growth aims to advance understanding in the areas of innovation, trade and institutions to identify policies and solutions that enhance economic growth and opportunity.

The views expressed in this paper are those of the authors and do not necessarily reflect the views of the Sheila and Robert Challey Institute for Global Innovation and Growth or North Dakota State University.